Quarterly Activities Report 31 March 2018

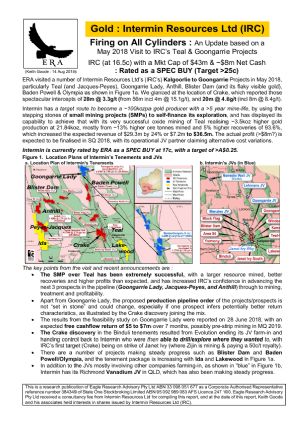

Perth, April 30, 2018 AEST (ABN Newswire) - Intermin Resources Limited ( ASX:IRC) ("Intermin" or the "Company") provides the March 2018 Quarterly Activities Report. Intermin is a gold exploration and development company with a key focus in the Kalgoorlie region of Western Australia (see Figure 1 in link below) and has a number of joint ventures in place with quality partners covering multiple commodities in Western Australia and Queensland.

ASX:IRC) ("Intermin" or the "Company") provides the March 2018 Quarterly Activities Report. Intermin is a gold exploration and development company with a key focus in the Kalgoorlie region of Western Australia (see Figure 1 in link below) and has a number of joint ventures in place with quality partners covering multiple commodities in Western Australia and Queensland.

HIGHLIGHTS

- Mining, ore haulage and toll treatment completed successfully at the Teal gold mine

- Transitional ore mined from Teal Stages 1 and 2 for the Quarter totalled 51,600t at a mine predicted grade of 2.54g/t Au for 4,200 ounces mined

- Two milling campaigns completed successfully at the Lakewood toll milling facility with final bullion shipped in April for refining and sale in early May

- Gold production for the Quarter of 6,737 fine ounces at C1 costs of $923/oz(see Note 1 below) and an AIC of $1,087/oz(see Note 2 below)

- A$11.5 million received from gold sales during the Quarter at an average gold price of A$1,701 per ounce

- Cash and tradeable securities increase to A$11.14 million(see Note 3 below)

- Excellent first pass drilling results received from the Blister Dam gold project area(see Note 4 below)

- Maiden (JORC 2012) Mineral Resource estimate for the Anthill gold project totalling 160,000t grading 1.7g/t Au for 78,000 ounces at a 1g/t Au cut-off grade(see Note 5 below)

- Updated Mineral Resource estimate for the Richmond vanadium project totalling 2,579Mt grading 0.32% V2O5 at a 0.29% V2O5 cut-off grade(see Note 6 below)

- Richmond JV partner AXF commits to spend a further A$5M on the project over 3 years

- Metallurgical testwork from the Richmond Vanadium Project underway in China under supervision of AXF with initial results expected in the June Quarter 2018

- Lakewood gold project area consolidated to the south east of Kalgoorlie's Golden Mile(see Note 7 below)

- Fully funded 55,000m Resource extension and new discovery drilling program(see Note 8 below) commenced with 7,300m drilled at the Teal gold project area during the Quarter

- Drilling results from Teal, Jacques Find and Peyes Farm expected in the June Quarter

- Janet Ivy Mining Royalty payments of $0.50/t now due after treated tonnages exceeded the prepayment threshold with regular quarterly payments expected through CY2018(see Note 8,9 below)

JUNE QUARTER ACTIVITES(see Note 8 below)

- Working toward a resolution of a cost variation claim received during the March Quarter from mining contractor Resource Mining Pty Ltd

- Ongoing exploration and new discovery drilling at Teal and Anthill

- Drilling results from the Teal gold project area

- Richmond Vanadium metallurgical test work results on ore pre-concentration

- Goongarrie Lady Feasibility Study completion

- Anthill scoping study completion and development options review

- Stakeholder engagement and drill program planning for the Lilyvale vanadium prospect

Notes:

1 C1 cash costs exclude pre-strip of Teal Stage 2

2 AIC cash costs include pre-strip, production, exploration and all overheads.

3 Includes 75% profit share component from Teal gold mine as per Intermin's position, see Page 5 for details

4 As announced to the ASX on 6 February 2018

5 As announced to the ASX on 13 March 2018

6 As announced to the ASX on 20 March 2018

7 As announced to the ASX on 19 February 2018

8 As announced to the ASX on 10 April 2018

9 See Forward Looking and Cautionary Statement on Pages 21 and 22

To view the full report with tables and figures, please visit:

http://abnnewswire.net/lnk/E75045KP

About Horizon Minerals Limited

Horizon Minerals Limited (ASX:HRZ) is a gold exploration and mining company focussed on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia's richest gold deposits. The Company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions. The Teal gold mine has been recently completed.

Horizon Minerals Limited (ASX:HRZ) is a gold exploration and mining company focussed on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia's richest gold deposits. The Company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions. The Teal gold mine has been recently completed.

Horizon is aiming to significantly grow its JORC-Compliant Mineral Resources, complete definitive feasibility studies on core high grade open cut and underground projects and build a sustainable development pipeline.

Horizon has a number of joint ventures in place across multiple commodities and regions of Australia providing exposure to Vanadium, Copper, PGE's, Gold and Nickel/Cobalt. Our quality joint venture partners are earning in to our project areas by spending over $20 million over 5 years enabling focus on the gold business while maintaining upside leverage.

| ||

|