State Gas Strategic Review

Brisbane, May 2, 2022 AEST (ABN Newswire) - State Gas Limited ( ASX:GAS) notes the recent record increase in the price of liquefied natural gas (LNG) amid the Russia-Ukraine conflict and the sanctions on imports of Russian energy imposed by several countries, including Canada, the United Kingdom, and the United States.

ASX:GAS) notes the recent record increase in the price of liquefied natural gas (LNG) amid the Russia-Ukraine conflict and the sanctions on imports of Russian energy imposed by several countries, including Canada, the United Kingdom, and the United States.

The World Bank's Commodity Markets Outlook Report released in April explains that war in Ukraine has dealt a major shock to commodity markets, altering global patterns of trade, production, and consumption in ways that will keep prices at historically high levels through the end of 2024. The long-term outlook for commodity markets depends heavily on the duration of the war in Ukraine and the extent of sanctions, with a material risk that energy prices could increase much more than forecast, especially if EU sanctions on Russian energy are broadened.

The World Bank also noted that previous energy price hikes led to the emergence of new sources of supply, and that changes in commodity trade patterns are expected to continue even after the war ends.

In light of the sustained high LNG prices and medium-term forecasts exacerbated by the war in Ukraine, State Gas has conducted a strategic review of its Central Queensland assets to determine the most cost effective and quickest route to market for its gas.

Critical in this regard are the following key factors:

- Gas produced from any part of the Company's acreage is able to be freely sold into the domestic market or exported (i.e. not subject to domestic gas reservation policies);

- Gas from each of the Company's 100%-owned projects is currently uncommitted; and

- Conventional gas from the northern area of PL231 (the Primero/Aldinga resource) and the coal seam gas at Rougemont in nearby ATP 2062 is essentially of pipeline quality, requiring only dehydration and compression to meet deliverability requirements.

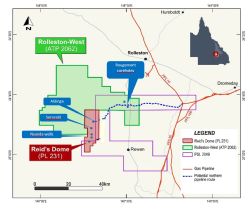

The preferred pipeline route identified is to the north and east through both Aldinga and Rougemont to connect to the main Queensland gas trunk line (see map below*).

Accordingly, State Gas has decided to prioritise the development of the conventional gas around Aldinga through a pipeline traversing the Rougemont field to the Rolleston compressor station.

Desktop studies have identified Aldinga to Rougemont as the optimal initial development plan, with the Nyanda area south of Aldinga to be developed as a subsequent phase. Initial field surveys are planned for next month.

In relation to the Rougemont gas area, nearby analogues for the development of the Bandanna coals show that horizontal drilling substantially lessens the time to peak production whilst materially elevating the peak production rate. State Gas therefore intends to drill a horizontal well into the two thickest seams that will intersect the existing Rougemont 2 vertical well.

Planning for this horizontal well is underway, with drilling expected during the coming Quarter.

State gas expects a first pass economic review to be completed in the third quarter of this calendar year and, depending on the outcomes of production testing of the proposed horizontal well at Rougemont, may then be in a position to apply for a pipeline licence with the aim of accelerating gas sales.

*To view Map showing location of permits, please visit:

https://abnnewswire.net/lnk/628JC0HE

About State Gas Limited

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

It will do this by applying an agile, sustainable but low-cost development approach and opportunistically expanding its portfolio in areas that are well located to gas pipeline infrastructure.

State Gas is 100%-owner of the contiguous Reid's Dome (PL-231) and Rolleston-West (ATP 2062) gas projects, both of which contain CSG and conventional gas. The Projects, together some 1,595km2 , are located south of Rolleston, approximately 50 and 30 kilometres respectively from the Queensland Gas Pipeline and interconnected east coast gas network. State Gas intends to accelerate commercialisation of these assets through the application of an innovative virtual pipeline ("VP") solution which will see the Company transport compressed gas by truck to existing pipeline infrastructure or to an end user.

State Gas also holds a 35% interest in ATP 2068 and ATP 2069 in joint venture with Santos QNT Pty Ltd (65%). These two new areas lie adjacent to or in the near vicinity of State Gas and Santos' existing interests in the region, providing for the potential of an alignment in ownership interests across the region over time and enabling synergies in operations and development.

State Gas is also participating in a carbon capture and sequestration initiative with minerals explorer Rockminsolutions Pty Ltd in respect of EPM 27596 which is located on the western border of ATP 2062. This project is investigating the potential of the unique basalts located in the Buckland Basaltic Sequence (located in EPM 27596) to provide a variety of in-situ and ex-situ carbon capture applications.

| ||

|