Annual Report to Shareholders

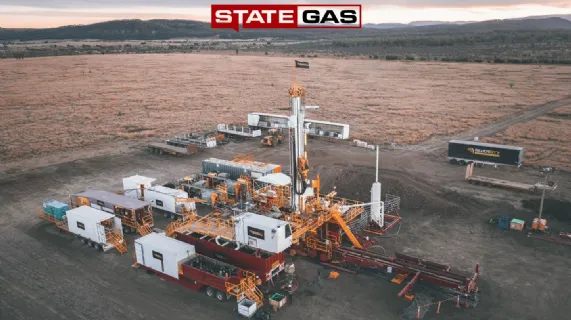

Brisbane, Sep 29, 2021 AEST (ABN Newswire) - The last financial year has been the year in which State Gas Limited ( ASX:GAS) marched towards reserve certification. Production testing at Nyanda-4 (coupled with production log testing) corroborated our theory that seams as deep as 1,100 metres were contributing to our gas flows. We prognosed that as a result of the geological disturbance which created the Dome there would be pathways for the high content gas to migrate to the well bore. This may lead to pockets of gas being trapped in the "cracks", which with concentric drawing down would become interconnected over time. It was pleasing to see flow rates of 700,000 cubic feet /day occur as our first "crack" was encountered.

ASX:GAS) marched towards reserve certification. Production testing at Nyanda-4 (coupled with production log testing) corroborated our theory that seams as deep as 1,100 metres were contributing to our gas flows. We prognosed that as a result of the geological disturbance which created the Dome there would be pathways for the high content gas to migrate to the well bore. This may lead to pockets of gas being trapped in the "cracks", which with concentric drawing down would become interconnected over time. It was pleasing to see flow rates of 700,000 cubic feet /day occur as our first "crack" was encountered.

The production testing at Serocold-1 was showing impressive build-up when the well sanded up. This occurrence is not unusual in coal seam gas and is generally remedied by "sleeving" the well. With the recent over-subscribed and cut-back fundraising completed, the Company intends to instal the "sleeve" at Serocold-1 and re-commence production testing this quarter. The results at Nyanda-7 & 8 initially showed promise but the production climb arrested. The Company believes this is a "skin" issue near well-bore and therefore jetting the requisite seams should restore the production climb. This is being trialled at Nyanda-8 this quarter.

Provided production tests at Serocold-1 and Nyanda-8 produce as expected, the Company should then be in a position to seek reserve certification - the next step to development - heralding our first Gas Sale Contract at a time of an extremely tight market. This Gas Sales Contract will underpin the development funding options.

Your Company believed that the market would tighten significantly in 2023 with price being the market clearing mechanism. Frankly, it is unbelievable that in a market shoulder period the JKM - the Asian LNG spot market indicator - has exceeded A$37/GJ for an extended period, causing the ACCC's Domestic Gas LNG Netback price to exceed A$22/GJ. The Price is Right for State Gas to come on down.

The core holes at Rougemont have been successfully completed. The results at Rougemont-2 were more than exciting with one seam of 2.4 metres showing permeability of 395mD with 96% methane. Just what the Doctor ordered! We intend to put Rougemont-2 into production testing with results expected in the first quarter next year.

As Rougemont is located between Reid's Dome and the gas trunklines to Wallumbilla (the domestic gas pricing point) to the South and Gladstone (the LNG export port) to the North, Rougemont will share infrastructure built for Reid's Dome- economically converting the Rougemont development into a brownfield development.

Richard Cottee

To view the Annual Report, please visit:

https://abnnewswire.net/lnk/HDQ97636

About State Gas Limited

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

State Gas Limited (ASX:GAS) (OTCMKTS:STGSF) is a Queensland-based gas exploration and development company with highly prospective gas exploration assets located in the southern Bowen Basin. State Gas Limited's mission is to support east coast energy markets through the efficient identification and development of new high quality gas assets.

It will do this by applying an agile, sustainable but low-cost development approach and opportunistically expanding its portfolio in areas that are well located to gas pipeline infrastructure.

State Gas is 100%-owner of the contiguous Reid's Dome (PL-231) and Rolleston-West (ATP 2062) gas projects, both of which contain CSG and conventional gas. The Projects, together some 1,595km2 , are located south of Rolleston, approximately 50 and 30 kilometres respectively from the Queensland Gas Pipeline and interconnected east coast gas network. State Gas intends to accelerate commercialisation of these assets through the application of an innovative virtual pipeline ("VP") solution which will see the Company transport compressed gas by truck to existing pipeline infrastructure or to an end user.

State Gas also holds a 35% interest in ATP 2068 and ATP 2069 in joint venture with Santos QNT Pty Ltd (65%). These two new areas lie adjacent to or in the near vicinity of State Gas and Santos' existing interests in the region, providing for the potential of an alignment in ownership interests across the region over time and enabling synergies in operations and development.

State Gas is also participating in a carbon capture and sequestration initiative with minerals explorer Rockminsolutions Pty Ltd in respect of EPM 27596 which is located on the western border of ATP 2062. This project is investigating the potential of the unique basalts located in the Buckland Basaltic Sequence (located in EPM 27596) to provide a variety of in-situ and ex-situ carbon capture applications.

| ||

|